Frequently asked questions

Who pays rates?

Rates must be paid by all property owners in the City of Greater Geraldton.

How can I pay my rates?

- Online

- Telephone

- Bpay

- In Person

- Mail

- Any Australia Post / Agency

For more information, go to the Rates payment options webpage.

Do I have to pay my rates all at once?

Council understands that sometimes people experience financial hardship which makes it difficult to meet all of their financial commitments when they are due. Please contact a Council Rates Officer to arrange a suitable payment arrangement to settle the rates debt by the end of the financial year.

What do my rates pay for?

Your rates contribute toward the services provided by the City including but not limited to:

- Aquatic Centre

- Arts, culture youth and heritage

- Assistance to community groups

- Beach services

- Building Applications - assessment

- Building control

- Bush fire control

- Citizenship ceremonies

- Community events and promotions

- Community health control

- Community information

- Council website

- Dog and other animal control

- Drainage

- Economic development support

- Emergency services support

- Environmental planning

- Fire prevention

- Footpaths

- Health Inspection of Food Premises

- Leased buildings

- Libraries

- Litter control

- Off road vehicle control

- Parking control

- Parks, gardens and playgrounds

- Planning and development applications

- Playground equipment

- Protection of the environment

- Public toilets

- Recreational and cultural planning and development

- Recreational facilities

- Road construction and maintenance

- Skate Parks

- Storm water drainage

- Street lighting and street trees

- Tourism, promotion and servicing

- Town planning scheme maintenance

- Verges and kerbing

- Waste management

- Youth services

How rates are calculated?

The council estimates the amount of income it will receive from general sources. These might be grants, licence fees, infringements, loans and interest earned on investments. Then the City works out the difference between what it needs to spend and its estimated income. This difference is called the deficit. It is the Ratepayers that make up the deficit by paying Rates (part of the whole amount needed).

The proportion each ratepayer pays is calculated using a property valuation supplied by the Valuer General this is the Gross Rental Value (GRV) or the Unimproved Value (UV) then multiplying by the rate in the dollar which is set by Council at the annual budget meeting.

GRV properties are re-valued once every three years. UV properties are re-valued annually.

What is a minimum rate or payment?

Local governments are able to set a minimum amount payable for properties. If the calculation of GRV/UV multiplied by rate in dollar is less than the minimum rate, then the minimum rate will be applied.

The purpose of the minimum payment is to ensure that every land owner makes a reasonable contribution to the rate burden.

The minimum rate payment for 2023/2024 is $1,027.

What is Emergency Services Levy (ESL)?

The ESL is the State Government imposed Emergency Services Levy. The City acts as a collection point for this charge, which is added to your council rates. For more information about the ESL visit the Department of Fire and Emergency Services website.

What is Gross Rental Value (GRV)?

The GRV is an annual rental value determined by Landgate Valuation Services (Valuer General's Office) once every 3 years. This means that properties are valued on their potential earning income rather than resale value.

What is Unimproved Value (UV)?

The UV is supplied by the Landgate Valuation Services (Valuer General’s Office) annually and is valued as though it remains in its original, natural state, although any land degradation is taken into account.

I disagree with the valuation of my property – GRV/UV?

Valuations - Your valuation (GRV or UV) is only one factor used to calculate your rates notice. The Valuation of Land Act 1978 (as amended) Part IV sets out how valuation objections may be lodged. A property owner may lodge an objection against the valuation of a property within 60 days of the date of issue of a rates notice. For information on how your values are calculated and how to lodge an objection, please visit Landgate’s website landgate.wa.gov.au/valuations, or alternatively call Landgate Customer Service on +61 (0)8 9273 7373.

Rates Record - Section 6.76 of the Local Government Act 1995 provides the grounds, time and the way individual objections and appeals to the Rates Record may be lodged. An objection to the Rate Book must be made in writing to the council within 42 days of the date of issue of a rates notice.

Section 6.81 of the Local Government Act 1995 refers that rates assessments are required to be paid by the due date, irrespective of whether an objection or appeal has been lodged. In the event of a successful objection or appeal, the rates will be adjusted, and you will be advised accordingly. Credit balances may be refunded on request.

I've lodged an objection to my rates and have received a final notice. Do I have to pay?

Yes, rates must be paid as assessed by the due date. Any reduction in rates as a result of a successful objection will be refunded. If you do not make payment in full, you will accrue interest on general rates and on Emergency Services Levy.

I have received a yellow rates notice, what is this?

This yellow notice is an Interim notice. You have received this because there has been a valuation change at your property. This is a separate bill to your original rates notice and must be paid by the due date.

What happens to my rates if I build a new house, an addition or a pool?

When there are changes to your property that affect its valuation, the City receives advice of the new valuation (and an effective date for the new valuation) from the Valuer General. An amended rate notice, called an interim rate notice, is then issued. An interim rate notice does not replace the original rate notice but is an additional charge therefore the total due on both needs to be paid.

Examples of where your valuation would be amended include:

- a new building has been built

- a pool has been installed

- a new room has been added

- a property has been demolished

I am a Pensioner / Senior, how do get a rebate?

To receive a concession a person must hold one or more of the appropriate Pensioner or Seniors cards, and on July 1 of the financial year, own and occupy residential property as their ordinary place of residence.

Please call the Water Corporation on 1300 659 951 with your concession card details. You can also apply for your concession online at the Water Corporation website. They will then update your details. Please have your Water Corporation account number ready when you call.

I am unable to pay my rates by the due date, can I pay weekly, fortnightly or monthly?

Yes, the City offers the opportunity to make a payment arrangement. Payments can be made on an agreed weekly, fortnightly or monthly basis by special arrangement or direct debit. You will be required to complete a form which can be found on the City’s website or by contacting the Rates Department on (08) 9956 6600 and dial 2 to speak to a rates officer.

Alternatively, anyone in receipt of a Centrelink payment can arrange to pay by Centrepay fortnightly from their benefits. Please contact a Rates officer to discuss this.

Note: all payment arrangements may be subject to interest and administration fees as per the adopted fees and charges.

Why are there fees and interest on instalment options?

As per the back of your rates notice, if you elect to pay by the instalment option they are to cover the costs of issuing the instalment reminders. The other component of the instalment fees is instalment interest. This is to offset the investment income that the local government would have received.

I paid my first instalment late, am I still able to go onto the instalment option?

Yes you can, however there is a cut-off date which is before the issue of the second instalment. Contact the Rates Department on (08) 9956 6600 and dial 2 to speak to a rates officer to advise them that you wish to pay by instalments. Please note interest will accrue on all overdue amounts after the due date.

How do I change my address details?

Property owners have an obligation to ensure the City has the correct address for the service of rates notices.

Change of address details can be sent to the City:

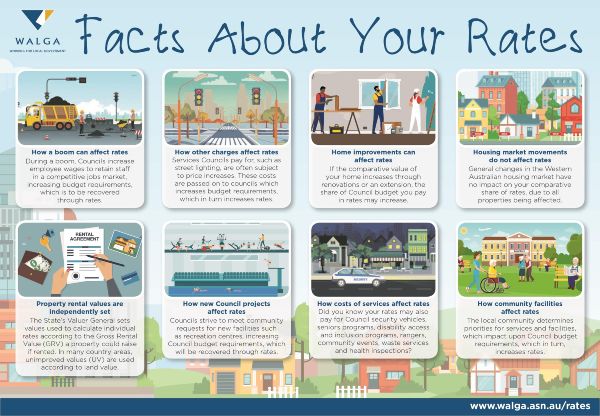

Education and facts about your rates

For more information, head to WALGA - About Local Government Rates in Western Australia | WALGA